Originally published June 27, 2017. Updated March 22, 2024.

Choosing a payroll schedule is a critical decision with many factors a business must consider.

For employers, it directly influences cash flow management. Opting for more frequent pay periods necessitates regular fund disbursements, impacting liquidity management.

The frequency of pay can impact expectations and job satisfaction for employees. Generally, employees favor more frequent pay periods for a steady income flow, which aids in financial planning and budgeting.

From an administrative perspective, payroll processing requires time and resources. Frequent pay periods increase workload because of additional calculations, data entry, and processing. Conversely, less frequent pay periods may challenge managing larger data volumes at once.

In the end, choosing the right payroll schedule for your business requires balancing competing priorities.

What Are Four Common Types of Pay Schedules?

Although payroll runs 52 weeks a year, only a few commonly used schedules make up a pay period. According to USA Today, a pay period is an established timeframe during which workers earn wages. Each period has a start and end date. A new pay period begins the day after the previous one finishes.

Common pay period cycles include:

- Weekly

- Biweekly

- Semi-Monthly

- Monthly

To calculate pay, a business tracks its employees' work hours during each pay period, including overtime and time off. Once the payroll department submits and processes the payroll information, employees receive their paychecks or direct deposits for that pay period.

Of the most common pay periods listed above, semi-monthly payroll tends to cause the most confusion. You may be asking, what does semi-monthly mean? Semi-monthly pay is payroll distributed to employees 24 times per year. Typically, employees receive it on the 15th and last day of each month.

It is also significantly different from the more common biweekly payroll schedule, despite sounding similar.

What's the Difference Between Biweekly and Semi-Monthly Payroll?

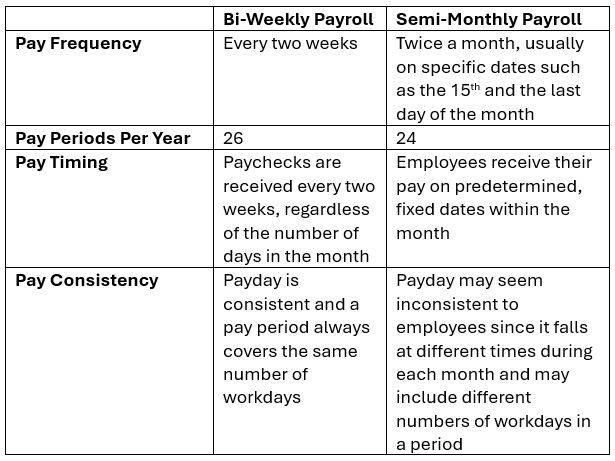

The differences between biweekly and semi-monthly payroll vary. Some key differences include how often and when employees get paid, how many paychecks they receive in a year, and whether or not pay dates stay the same.

Let's look at some examples below:

How Do You Calculate Semi-Monthly Pay?

Calculating semi-monthly pay isn't as straightforward as other payroll schedules. This is especially true when dealing with non-exempt employees. A common mistake with semi-monthly pay is assuming a fixed number of hours, like 86.67 hours, for each pay period.

Employers must track and pay for all hours actually worked — including overtime — each workweek, not an average. Each month varies in the number of workweeks it contains, impacting semi-monthly pay periods with fluctuating days.

Let's look at an example:

Let's say pay period 1 runs from the 1st through the 15th with payday on the 15th. Then, pay period 2 runs from the 16th through the last day of the month with payday on the last day of the month. Let's also say the business operates Monday through Friday, and the employer defines the workweek as Monday through Sunday.

In the example above, for July, the first pay period includes 10 workdays, with a payday on July 15th. The second pay period includes 11 workdays with payday on July 31st. If we were to assume an employee works an eight-hour day, then the following is true:

- Pay Period 1 = 80 regular hours

- Pay Period 2 = 88 regular hours

But what about overtime?

With semi-monthly payroll, some weeks start and end in the same pay period. Other weeks start in one period and end in the next. When an employee works overtime during a week that spans two pay periods, their overtime pay cannot be determined until the second pay period.

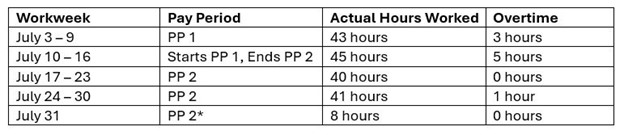

To better understand, let's review the chart below, which shows an example of workweeks throughout July:

On payday, how many hours will this employee receive payment for?

July 15 (Pay Period 1) = 80 regular hours plus 3 overtime hours

July 31 (Pay Period 2) = 88 regular hours plus 6 overtime hours

As you can see, this employee worked all the expected regular hours during both pay periods in July. The employee received three hours of overtime pay on July 15th for the first pay period. The second workweek of the month (July 10th - July 16th) fell between the first and second pay periods. This caused five hours of overtime earned during the second workweek to be held until July 31st, along with one overtime hour earned in the fourth week of the month.

Note: Although regular hours for July 31st were paid in July's second pay period, any overtime worked during the second pay period (July 31st - August 6th) will not be compensated until the first pay period of August.

Pros of Semi-Monthly Payroll

Generally, a semi-monthly pay schedule, or pay period, fits well with business cycles. It integrates smoothly with monthly accounting, budgeting and forecasting, cash flow management, and performance evaluation. This helps companies maintain stability, consistency, and efficiency in their payroll processes while supporting broader business objectives and financial management practices.

- Cash Flow. Businesses can better plan and budget by predicting cash outflows and ensuring enough funds are available for payroll expenses. This can help companies avoid liquidity issues and associated costs, such as overdraft fees or borrowing costs.

- Fits Into Business Cycle. Many businesses use a monthly accounting cycle to make financial statements, review budgets, and analyze financial performance. Semi-monthly payroll neatly aligns with this cycle, offering two pay periods each month. This allows for a more streamlined tracking of labor costs and seamless integration with financial reporting.

- Budgeting and Forecasting. Having two pay periods each month allows companies to predict and allocate funds more precisely for payroll expenses. This ensures effectively managing a budget as well as helping meet financial goals.

- Operational Alignment. Businesses usually have operational cadences that include regular activities such as inventory management, production planning, and sales reporting. Semi-monthly payroll provides a regular cadence for paying employees, which can help maintain stability and consistency.

- Compensation Incentives. Many companies conduct performance evaluations and administer incentive programs on a monthly or quarterly basis. Semi-monthly payroll helps set performance expectations and makes it easier to manage incentive programs based on performance measures.

Cons of Semi-Monthly Payroll

Semi-monthly pay periods require careful attention to detail and effective payroll management to navigate through multiple complexities. Some of these complexities include varying workdays, overtime calculations, scheduling challenges, budgeting considerations, accruals, deductions, and compliance requirements. Challenges generally arise from:

- Varying Workdays. The variation in the number of workdays in a workweek can complicate payroll calculations, especially for hourly workers.

- Irregular Schedules. Employees with inconsistent schedules or whose overtime eligibility resets each pay period may struggle to figure out their overtime pay.

- Pay Periods Extend Between Months. Pay periods often overlap into the next calendar month, which can create challenges for scheduling payroll processing. This is especially true when running final numbers for each month.

- Processing Accruals. The calculation and processing of accruals and deductions, like vacation, benefits, and retirement contributions, can be affected. Making sure calculations match pay periods needs coordination and attention from different departments.

- Compliance. It's critical to ensure compliance with labor laws and regulations that govern pay frequency, overtime pay, and wage deductions. This requires a thorough understanding of applicable laws and monitoring to avoid violations and penalties.

As you can see, there are many factors to consider when deciding when and how often to pay your employees. While some options, such as weekly, monthly, and bi-weekly pay periods, are common, a semi-monthly pay schedule may be difficult to understand. However, this should not deter employers from exploring this option.

While paying employees twice a month can be difficult for administration and calculating overtime pay, it does have its own set of benefits. A semi-monthly pay period can help businesses manage money and track employee pay more easily, improving financial organization.

Before deciding if a semi-monthly pay period is right for a business, employers should know the pros and cons. This will help to ensure fair pay for all employees and compliance with state regulations. Understanding semi-monthly pay periods and how they work, can help you decide if it's right for your business.