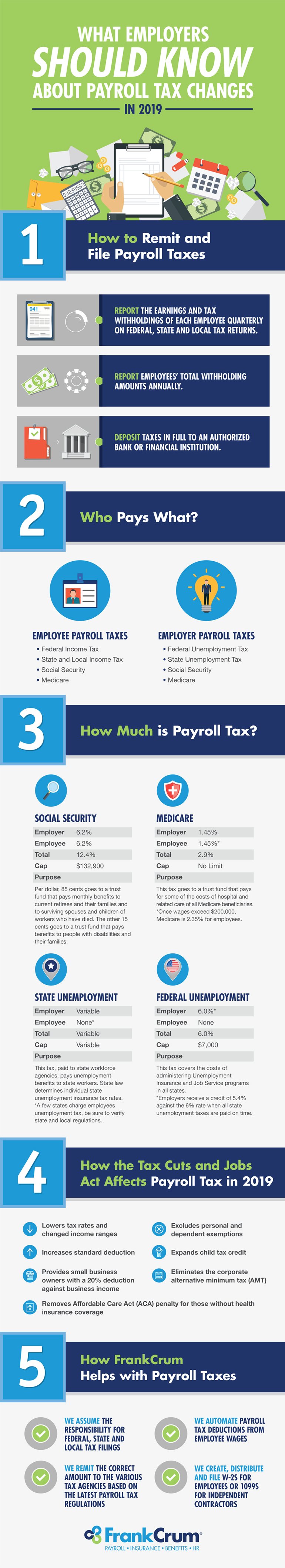

Payroll taxes are one of the most complicated parts of paying employees, and one of the easiest areas to make a mistake. As a standard, an employee’s paycheck consists of federal income tax, Social Security and Medicare. If an employer conducts business in a state with state income tax withholding, he or she will need to withhold state income tax as well.

Payroll taxes are one of the most complicated parts of paying employees, and one of the easiest areas to make a mistake. As a standard, an employee’s paycheck consists of federal income tax, Social Security and Medicare. If an employer conducts business in a state with state income tax withholding, he or she will need to withhold state income tax as well.

The Tax Cuts and Jobs Act, passed in December 2017, brings additional changes for payroll taxes, like an increase in the standard deduction and exclusions of personal and dependent exemptions.

Some of the questions employers often have about payroll taxes include the following:

- How do I remit and file payroll taxes?

- Who pays what?

- How much should be deducted from an employee’s pay?

- How much is payroll tax for the employer and employee?

- Can someone else handle payroll taxes for me?

For answers to these frequently asked payroll tax questions and more, take a look at our free infographic.