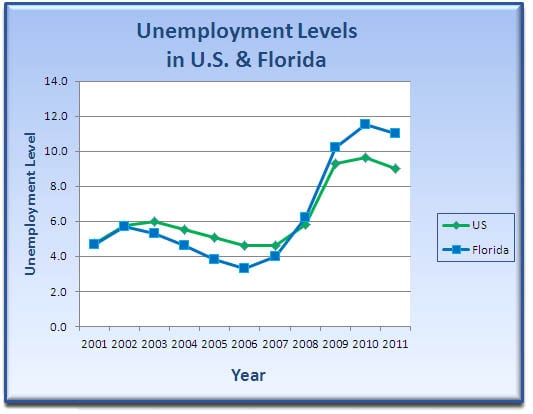

The unemployment rate might be slowly on the way down, but unemployment taxes continue to soar. Taxes are up 1.2% since 2009. Florida employers will pay a minimum of 2.02% on the first $8,500.00 of taxable income per employee in state unemployment taxes in 2012. This percentage was only .12% as recently as 2009. It has steadily risen as the unemployment rate has more than tripled over the past 5 years.

In addition, Florida’s federal unemployment taxes are increasing to an unprecedented 1.2% in 2012, up .3% from last year. This means that Florida employers will be paying a minimum of 3.22% on the taxable income of each employee up to the respective limits.

Until 2009, Florida was always able to pay all unemployment claims from the Unemployment Compensation Trust Fund, the balance of which was maintained by employer taxes. However, as the unemployment rate skyrocketed over the past few years, the balance of this fund fell to zero and Florida had to turn to the federal government to pay its unemployment claims. As of December, 2011, Florida has borrowed over $1.7 billion to pay unemployment benefits.

Part of the dramatic increase in unemployment taxes is that federal law dictates that when a state’s unemployment trust fund loan has been outstanding for two consecutive years they are subject to an increase in federal unemployment taxes through a credit reduction.

Photo Courtesy of Jannoon028 freedigitalphotos.net

Every year that Florida’s loan remains unpaid this tax will continue to be increased by .3%. In an effort to pay off the balance of this loan, we are seeing an increase in our state unemployment taxes as well.

Although there is nothing employers can do to escape high unemployment taxes, there are things that you can do to cut down on unemployment claims, and therefore lower Florida’s unemployment rate. According to unemployment insurance experts nearly ten percent of our state’s unemployment claims are fraudulent.

Rich Gibaldi, a pricing specialist supervisor at FrankCrum suggests a few simple steps that employers should take to minimize mishandled unemployment claims. Make sure that you keep record and documentation of employee issues Gibaldi recommends. This will assist in when establishing cause for termination. In addition, proper use of job descriptions and performance appraisals are also helpful in placing the right candidate in a position and helping them to succeed.

“If you think an unemployment claim is fraudulent- challenge it,” says Gibaldi.

Another solution for cutting down on unemployment costs is to partner with a Professional Employer Organization like FrankCrum. A PEO acts on behalf of the employer and assists by managing HR Administrative Services. Additionally, working with a PEO helps to minimize your unemployment claims by developing proper job descriptions, managing claims, conducting investigations and holding telephone hearings.