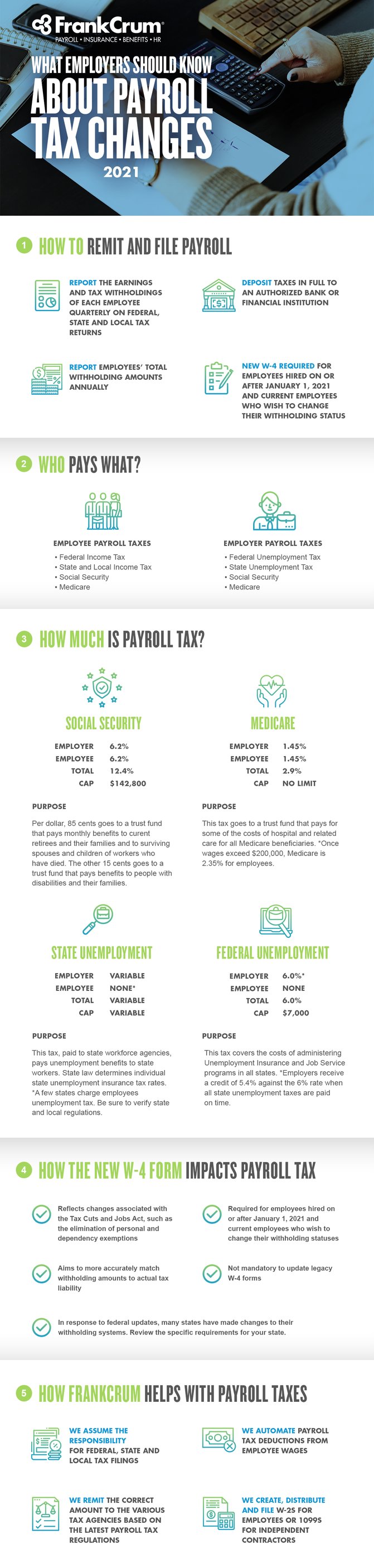

Numerous payroll changes are taking effect in 2021, and if they aren’t done correctly, they’ll be a big headache for your business. As a standard, an employee’s paycheck consists of federal income tax, Social Security and Medicare.

Numerous payroll changes are taking effect in 2021, and if they aren’t done correctly, they’ll be a big headache for your business. As a standard, an employee’s paycheck consists of federal income tax, Social Security and Medicare.

For 2021, Social Security payroll tax increased by $5,100 to $142,800 — increasing from $137,700 in 2020. In addition, a new W-4 is required for employees hired on or after January 1, 2021, and current employees who wish to change their withholding statuses.

We want to help ensure your business runs smoothly, which is why we’ve created this handy infographic with payroll tax changes you should know in 2021.