The POE Group is a Tampa Bay-based independent compensation consulting firm with over 25 years of experience partnering with clients ranging from small businesses to Fortune 1000 companies across various industries. Their expertise includes all facets of compensation, from general employee to sales and executive compensation consulting.

The federal minimum wage rate has not changed since July 24, 2009 and has remained at $7.25 per hour. The time since the last update to the minimum wage is the longest since the 1938 passage of the Fair Labor Standards Act.

Recently, the Raise the Wage Act was reintroduced in Congress; this act would bring the minimum wage up to $15 per hour by June 2025 using annual increases.

The Bite of Inflation on a Stagnant Minimum Wage

Since well over a decade has elapsed without an increase to the minimum wage, inflation has continued to erode the purchasing power of anyone paid at the federal minimum wage level.

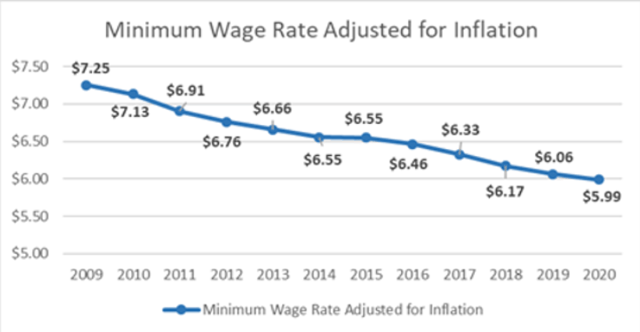

When adjusted for inflation, the value of the $7.25 minimum wage has diminished to roughly $5.99 by the end of 2020. The following graph shows the decline of the inflation-adjusted hourly minimum wage from 2009 to 2020:

Source: Inflation data sourced from the Bureau of Labor Statistics (BLS)

Applying Annual Wage Increases to Set the Federal Minimum Wage

It is difficult to argue that the current federal minimum wage is reasonable, but that begs the question of what it should be. Some members of Congress support making the minimum wage $15 per hour by 2025, while others argue that the change is too drastic. Either way, an increase to the federal minimum wage is inevitable — the question is to what level.

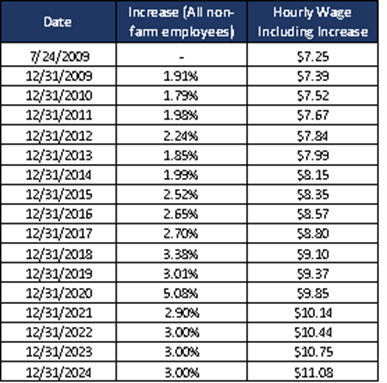

If market-based pay changes were applied to the minimum wage from 2009 to 2025 using annual compounding, we could get an idea of where the minimum wage should be — though this assumes, of course, that the $7.25 in 2009 was appropriate to begin with.

The year-over-year changes in private sector hourly wage rates since 2009 (sourced from the Economic Policy Institute) were applied to get an estimate of the minimum wage by the year 2025.

The table to the right shows how annual increases would influence the minimum wage over time, eventually landing around $11 per hour by the end of 2024.

The table to the right shows how annual increases would influence the minimum wage over time, eventually landing around $11 per hour by the end of 2024.

Whether we consider how inflation has diminished the current minimum wage or what the minimum wage would look like if it were updated to reflect market-based increases, it is reasonable to ask if changes are needed to bring the minimum wage set back in 2009 in line with 2021 and beyond.

Federal vs. State vs. Local

A number of states have recognized the need for change, and 20 states enacted minimum wage increases on January 1, 2021. These changes are in addition to other states (and many cities and counties) that had already enacted minimums above the federal requirements.

Beyond state and local changes, some companies have recently decided to raise the pay of the lowest-paid workers; both Chobani and Wayfair recently set their minimums at $15 per hour.

There is an argument that the minimum wage should be set differently based on wage differentials in different areas of the country.

For example, prevailing wages for the same job are different in Selma, Alabama and San Francisco, California. States and cities have adopted higher minimum wages partly in recognition of the differences.

Preparing for the Minimum Wage Increase

One way or another, pay for lower-paid workers is increasing, whether by federal legislation, actions by state and local governments, or even competitive pressure from other companies.

Companies need to begin planning how to implement these types of changes in advance, rather than being caught off guard when new laws are passed.

A rather simple first step for companies to take would be to see how many employees they have that are currently paid below $15 per hour (or another applicable rate), then calculate how much it would cost to bring all of these workers to the new rate.

When running this calculation, it is important to consider factors like overtime, employment taxes, benefits, and incentive payments (if applicable) to ensure that the full cost is captured.

The Ripple Effect of Wage Compression

After determining the financial implications of an increase to minimum wage requirements, the next (and more difficult) compensation issue for companies to tackle will be wage compression.

Wage compression describes the situation when there is only a minor difference in pay between employees that may have significant differences in skills or experience. If the minimum wage was increased, lower-skilled employees may suddenly be paid similarly to those with higher skills, resulting in internal equity problems.

It may become necessary for companies to update their salary structure to mitigate this problem, and beginning to plan for this situation now makes good business sense.

Understanding how changes to the minimum wage at the federal (or state/local) level could impact salary planning and budgets could help businesses plan for changes, potentially implementing increases in steps, rather than being forced to make significant changes all at once.

In addition to our current FrankAdvice services, FrankCrum is working with the POE Group to offer top-notch compensation consulting at a reasonable price. With expert knowledge, personalized client service, and an emphasis on communication, the POE Group's professionals help companies align their compensation approach with their business goals and company culture. An initial compensation consultation with the POE Group is available to FrankCrum clients at no cost.